What Does Accounting Franchise Mean?

Table of ContentsGet This Report on Accounting FranchiseLittle Known Facts About Accounting Franchise.Accounting Franchise Things To Know Before You BuyGetting My Accounting Franchise To WorkThe 10-Minute Rule for Accounting Franchise8 Simple Techniques For Accounting FranchiseAccounting Franchise Fundamentals Explained

By dealing with these certain demands, franchise business organizations can keep exact monetary documents, satisfy contractual responsibilities, and make sure the successful operation of their franchise business places. The value of making use of a certified franchise accounting professional can not be overemphasized when it concerns franchise accounting. Accounting Franchise. Franchise companies operate under a distinct set of financial circumstances and laws, making it essential for franchise business owners to have an accountant that recognizes the ins and outs of this company modelFranchise accounting professionals extensively examine the financial debt framework, consisting of superior loans and passion prices, to identify possibilities for refinancing or bargaining far better terms with loan providers. Lower-cost choices can substantially affect the franchisee's financial health and overall earnings.

Facts About Accounting Franchise Uncovered

Their know-how in economic evaluation and financial debt monitoring permits them to suggest franchisees on the most effective strategy. Optimizing company performance involves constantly changing techniques to line up with monetary objectives. Franchise business accounting professionals aid franchisees recognize the financial ramifications of various debt administration techniques and assist in executing them effectively.

Accounting Franchise - The Facts

It aids franchise owners stay on top of their financial position and take prompt activities to make sure excellent cash money flow. To conclude, the best approach to make certain good capital in franchise business bookkeeping is to keep to a spending plan. By recognizing and categorizing repeating and unpredictable costs, creating a cash circulation statement, and using a capital control panel, franchise business proprietors can effectively handle their economic resources and make certain the success of their business.

The franchisor is like a not-so-quiet partner in a franchise business venture, which indicates they deserve to examine your bookkeeping documents any kind of time they suspect something is awry. Even if all they locate is an audit error or 2. Being a franchisee likewise indicates that you should stick to the franchisor's audit criteria.

From the franchisor's financial health and wellness to the initial investment needed, recurring costs, and also lawsuits background, the FDD supplies a thorough appearance into the franchisor-franchisee partnership. Understanding the FDD is important for new franchisees, as it encourages them to make enlightened decisions concerning their financial investment (Accounting Franchise). By evaluating the document, prospective franchisees get clearness on the risks, obligations, and potential rewards associated with joining the franchise business system, guaranteeing they become part of the collaboration with eyes broad open

Accounting Franchise Things To Know Before You Get This

Franchises commonly have recurring aristocracy charges, advertising and marketing charges, and other expenses not regular of independent companies. You'll desire to make certain you're conscious of all of the franchise business fees hop over to these guys you'll be subject as well. You'll desire to make certain these costs are consisted of in your financials, and be certain your accountant or accounting professional is conscious as well.

New franchisees must focus on understanding the tax obligation effects connected to franchise charges, royalties, and other continuous payments to the franchisor. Accounting Franchise. In addition, new franchisees must additionally recognize state and regional tax laws controling their operations, including revenue tax obligation, sales tax, and employment taxes. When you have a franchise not only will be you accountable for keeping care of its publications, yet be certain it's operating lawfully

The Accounting Franchise Statements

Many organization owners and franchisees start off believing they can do it all on their own. Instead of taking care of your very own books, it pays to hand them off to experts.

It's one point to have your financials generated every month, it's another thing to understand them and utilize the numbers to your advantage. When you begin off as a new franchisee, it is very important to create a strong foundational understanding of economic statements (profit & loss, equilibrium sheet) to keep an eye on performance.

From the beginning, establish a system for monitoring receipts, invoices, and various other monetary records for tax and reporting purposes. This is typically performed in audit software application, where accessibility is after that provided to a bookkeeping specialist to monitor and generate records for regular monthly tracking. Mentioning reports, remaining in song with and on top of your finances and forecasts is one more way to remain effective and range.

Accounting Franchise Can Be Fun For Everyone

Once more, we can not emphasize this enough. Don't think twice to look for guidance from a certified accounting professional with franchise proficiency. Whether it's tax prep work, bookkeeping, conformity, or other locations, outsourcing jobs that you're not a professional in will allow you published here to concentrate on the everyday procedures while the professionals handle the remainder.

If you have an interest in helping other businesses enhance their procedures and why not look here profits while constructing your very own successful organization, then beginning an accounting franchise business might be a wonderful suitable for you. When you begin an accountancy franchise, not only do you obtain support and a respected name support you yet you also can feel great that you'll be using a tried and tested business version rather than starting from scratch.

Some bookkeeping franchises specialize in one classification while others may offer a suite of services. Numerous companies will have a fundamental understanding of the groups detailed above, they frequently don't have the time or sources to handle them as effectively as possible.

What Does Accounting Franchise Do?

Relying on your aspirations, you might work part-time, permanent, or a combination. Working from another location also provides you the possibility to deal with a selection of clients that may or might not be in the same city as you. Given that many bookkeeping franchise business are operated remotely, franchisees don't require to rent office space or spend for utilities at a separate place from their home.

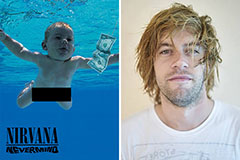

Spencer Elden Then & Now!

Spencer Elden Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now!